A) ALFI’s Report of 2024

Association of the Luxembourg Fund Industry (“ALFI”) published its annual report as to 2023-2024 (the “Report”) on 23 June 2024. The Report has plenty of insights regarding ALFI’s work and accomplishments as well as the state of the industry.

B) Foreword

In the Foreword of the Report, Jean-Marc Goy, the Chairperson of ALFI and Serge Weyland, Chief Marketing Officer of ALFI, highlight several key developments regarding ALFI’s structure and management. The Report explains that ALFI’s priorities focused on four main pillars: (i) shaping regulation, (ii) developing best practices, (iii) identifying new business opportunities, and (iv) promoting Luxembourg internationally.

Mr. Serge explains in the Report that in order to remain competitive Luxembourg aims to be the world’s leading cross-border domicile for funds, accommodating a diverse range of investment strategies and asset classes. It is further explained that Luxembourg is addressing challenges in talent retention and leveraging its central European location.

C) Industry at a Glance

According to the Report as of April 2024 the amount of total net assets in Luxembourg investment funds reached €5,421 billion, which has witnessed a 5.5% increase since the previous year.

One striking observation in the Report indicates that by the end of March 2024 there were 115 ELTIFs in Europe (in funds units) and 80 of them were domiciled in Luxembourg.

Furthermore, it is emphasized that Luxembourg remains the leader in global cross-border fund registrations with a whooping market share of 54.6%.

D) Luxembourg’s Market Leadership

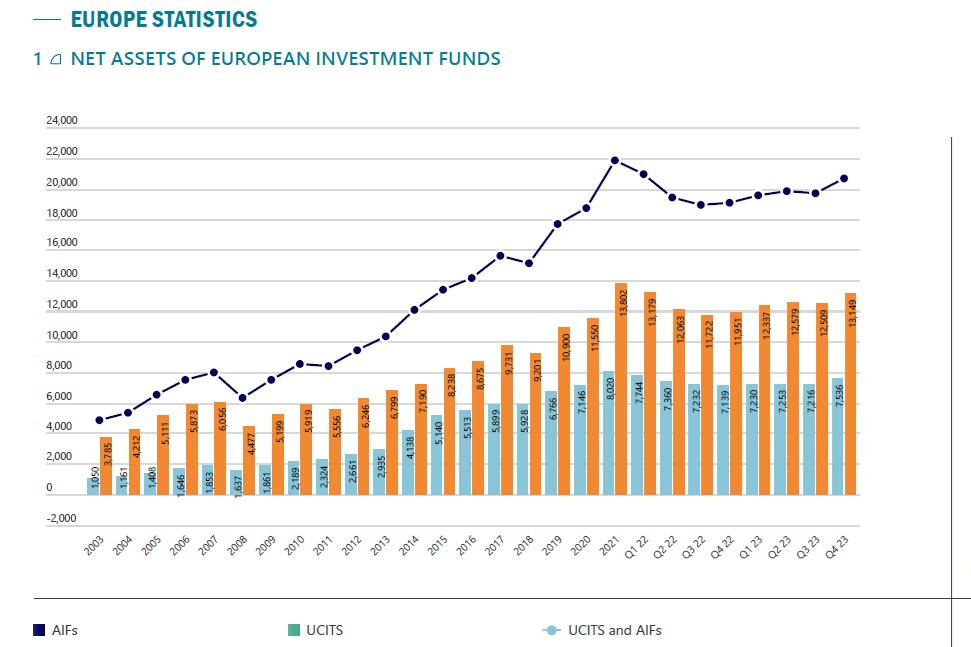

The Report also shares the distribution of total assets under management (for both UCITS and AIFs) in the European markets. For both UCITS and AIFs Luxembourg is the market leader with 25.6% and 32.6% market shares respectively. For UCITS, Luxembourg is followed by Ireland, Germany, France and the UK and for AIFs Luxembourg is followed by Ireland, the UK, France and Switzerland.

The Report points out that twenty years ago, the net assets under management in Luxembourg funds was €1,106 billion and now it is at the level of €5,485 billion which almost amounts to a five-fold increase.

E) ALFI’s Activities in 2024

The Report shares that ALFI organized a total of 48 events between May 2023 and April 2024 with a total of 9,800 attendees. One event was Globam 2024 (click here for the post-conference report).

F) Investment Policies of Luxembourg Funds

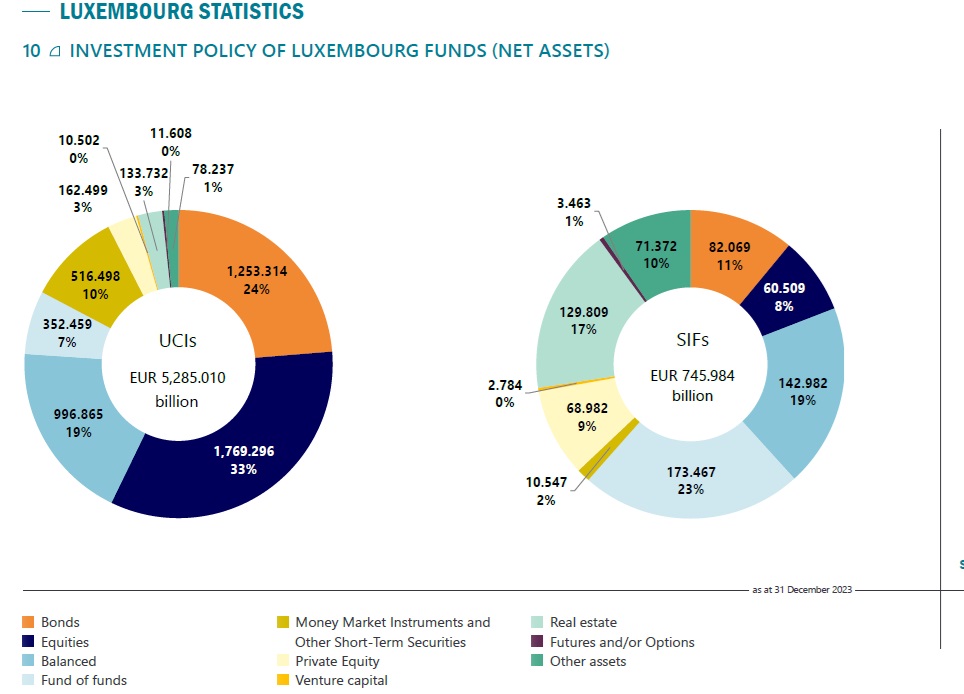

The Report indicates that 13,981 UCI fund units had the following investment strategy distribution:

- Equities – 30%

- Balanced – 23%

- Bonds – 22%

- Fund of funds – 14%

- Private equity – 4%

- Real estate – 2%

- Money market instruments and other short-term securities – 1%

- Venture capital – 1%

- Futures and/or options – 1%

- Other assets – 2%

The Report also indicates that 3,152 SIF fund units had the following investment strategy distribution:

- Fund of funds – 34%

- Balanced – 22%

- Real estate – 10%

- Bonds – 10%

- Equities – 8%

- Private equity – 7%

- Other assets – 7%

- Venture capital – 1%

by Can Ergur