Introduction

The simplified limited liability companies (SARL-S) (société à responsabilité limitée simplifiée) is a variant of the regular SARL under the laws of Luxembourg. It provides many advantages for new business set-ups, especially for entrepreneurs, thanks to its simplified procedures.

SARL-S is actually a relatively new concept in Luxembourg. For the first time, it was enacted by the law of 23 July 2016, which entered into force on 16 January 2017. Until that time, a company with limited liability required a minimum share capital of at least EUR 12,400 (and since 2016, EUR 12,000). The Luxembourgish legislator, however, realized that there is an increasing need for a new kind of limited liability company that is more suitable for entrepreneurs. Therefore the law dated 23 July 2016 was introduced, which created the simplified private limited liability company (the “SARL-S”).

Advantages of SARL-S

SARL-S set-ups can provide several advantages to ‘self-employed’ entrepreneurs or new businesses, such as:

- Min. share capital of EUR 1. The share capital must be between EUR 1 and EUR 11.999, hence the nickname ‘one-euro-company’.

- Simplified administrative costs. As opposed to a regular SARL, a simplified SARL can be incorporated only by a private deed without having to go through a notary.

- Same liability protection as a regular SARL. The SARL-S offers entrepreneurs with the advantage of being only liable with the company’s debts in proportion to a shareholder participating interest in its capital.

“The share capital of an SARL must be between EUR 1 and EUR 11.999, hence the nickname ‘one-euro-company’.”

Can Ergur

Disadvantages of SARL-S

Carrying out business under the SARL can also come with certain disadvantages, such as:

- Not suitable for all profiles. The SARL-S is only intended for natural persons with a business permit. This condition alone excludes a large group of professions and entities from choosing an SARL-S. In addition, it is also unsuitable for companies that require a large initial investment. If you already know that you will have high and recurring running costs (such as advance payments on rent, purchasing merchandise, purchase of equipment, etc.) (like a restaurant or a grocery store for example) it would not be an appropriate business form.

- Accounting and tax charges are equivalent to those of a regular SARL. Carrying out business under an SARL-S will not save from you the costs of accounting and tax charges. These may include: registration fees for obtaining the business permit, accounting expenses, account maintenance charges, taxes, VAT, etc. Keeping the accounts of SARL-S will typically cost between EUR 2,000 and EUR 5,000 a year.

- The obligation to create reserve fund. It is obligatory for at least 5% of the annual net profits of an SARL-S to be allocated to a reserve fund. This requirement is applicable until the fund, added to the initial capital, reaches EUR 12.000.

- Lack of credibility. SARL-S may suffer from a lack of credibility with banking institutions. banks would be unlikely to grant a large amount of loan if the company’s share capital is not high enough. In those case, banks would ask for a personal guarantee from the shareholder, which would defeat the purpose of establishing a simplified SARL in the first place as opposed to a regular SARL. Nonetheless, most suppliers, clients or business partners that work with SARL-S will more likely than not require such a personal guarantee.

“If you already know that you will have high and recurring running costs, SARL-S would not be an appropriate business form.”

Can Ergur

Setting Up an SARL-S

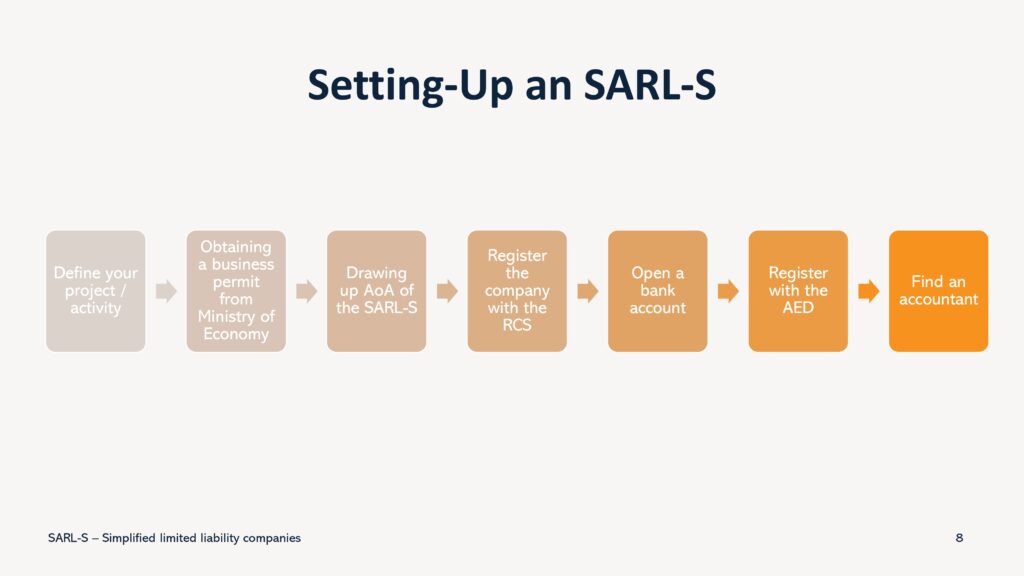

- Define your entrepreneurial project or activity. This step is usually overlooked by many entrepreneurs but it is actually crucial for you to define your activity with clarity. The purpose must fall within a certain scope, which encompasses craft trades, certain business and industries as well as certain liberal professions. If a business falls outside the scope of activities provided by the Ministry of Economy, it cannot use an SARL-S (such as healthcare, educational professions, etc.).

- Obtaining a business permit from the Ministry of Economy. You must also check whether other types of licenses or authorizations are required to carry out the activity that you intend to engage in.

- Drawing up the articles of association of the SARL-S. This can be done either by a private deed or through a notary.

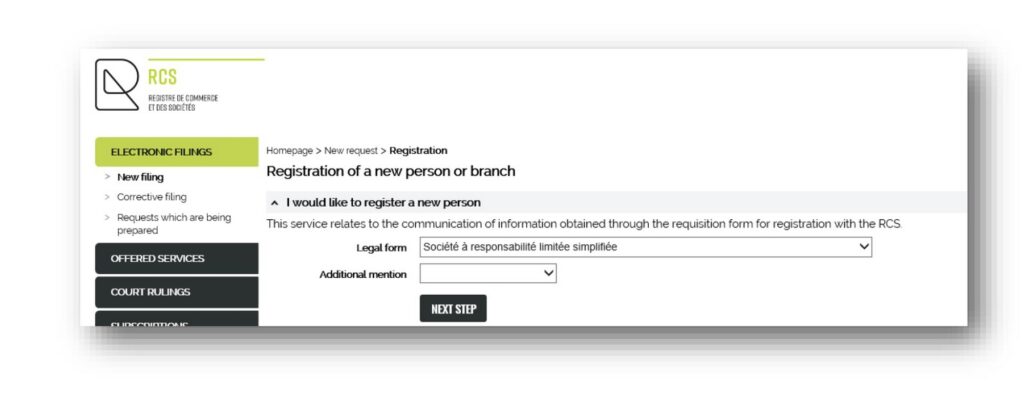

- Register the company with the Trade and Companies Register (RCS).

- Open a bank account. (This can also be done in parallel to the RCS registration, but it must be done with the business license approval).

- Register with and make the mandatory declarations to the VAT authorities (AED).

- Inform the social contributions CCSS whether you will run a payroll. If you will run a payroll, you will need to have a payroll provider who can register you. You will need to pay the monthly contributions to the CCSS (Centre commun de la sécurité sociale) which will depend on the salary amount.

- Find an accountant to file annual accounts.

Tips & Recommendations

- Templates for articles of association are available on Guichet.Lu website. The Articles of Association must be submitted to the trade registry (LBR) in their French or German version.

- Please bear in mind that in many stages of this process you will need a LuxTrust account in order to identify yourself on the Government sites.

- In addition, an SARL-S can only be manager by agents who are natural persons. Therefore legal entities cannot be the managers of simplified SARL set-ups.

- To reach the online brochure provided by Luxembourg Business Registers (LBR) regarding the SARL-S, please click here.

- You do not need to be Luxembourg national in order to set-up a SARL-S. EU residents can set up their company in Luxembourg, however to do this you will need real premises and not just a domiciliation or mailbox. For non-EU nationals, a residence permit will be required.

- Professional insurance is also something that you must factor in when creating a SARL-S, or any company for that matter.

- The shares of an SARL-S are “registered shares”. Neither shares in the company’s capital, nor profit shares may be issued to the public.

Conclusion

Starting a business is not an easy decision and it requires a lot of preparation. It is essential to choose your legal status carefully and assess the specific requirements of your business activity as well as your financial needs. Depending on your conditions, simplified limited liability companies (SARL-S) can be a great option for new business set-ups and entrepreneurs.

Ali Can Ergür